What’s Next for the 2025 Housing Market? Here’s What Experts Predict

Can you believe we’re already halfway through 2025?

As we head into the second half of the year, a lot of buyers and sellers are asking the same thing: What’s next for the housing market?

While no forecast is guaranteed, economists from Fannie Mae, Zillow, NAR, MBA, and others have released updated projections on everything from home prices and mortgage rates to sales activity and market recovery.

In this post, I’ve rounded up the key takeaways from their mid-year outlooks—and added a breakdown of what they could mean for our local market here in Hampton Roads.

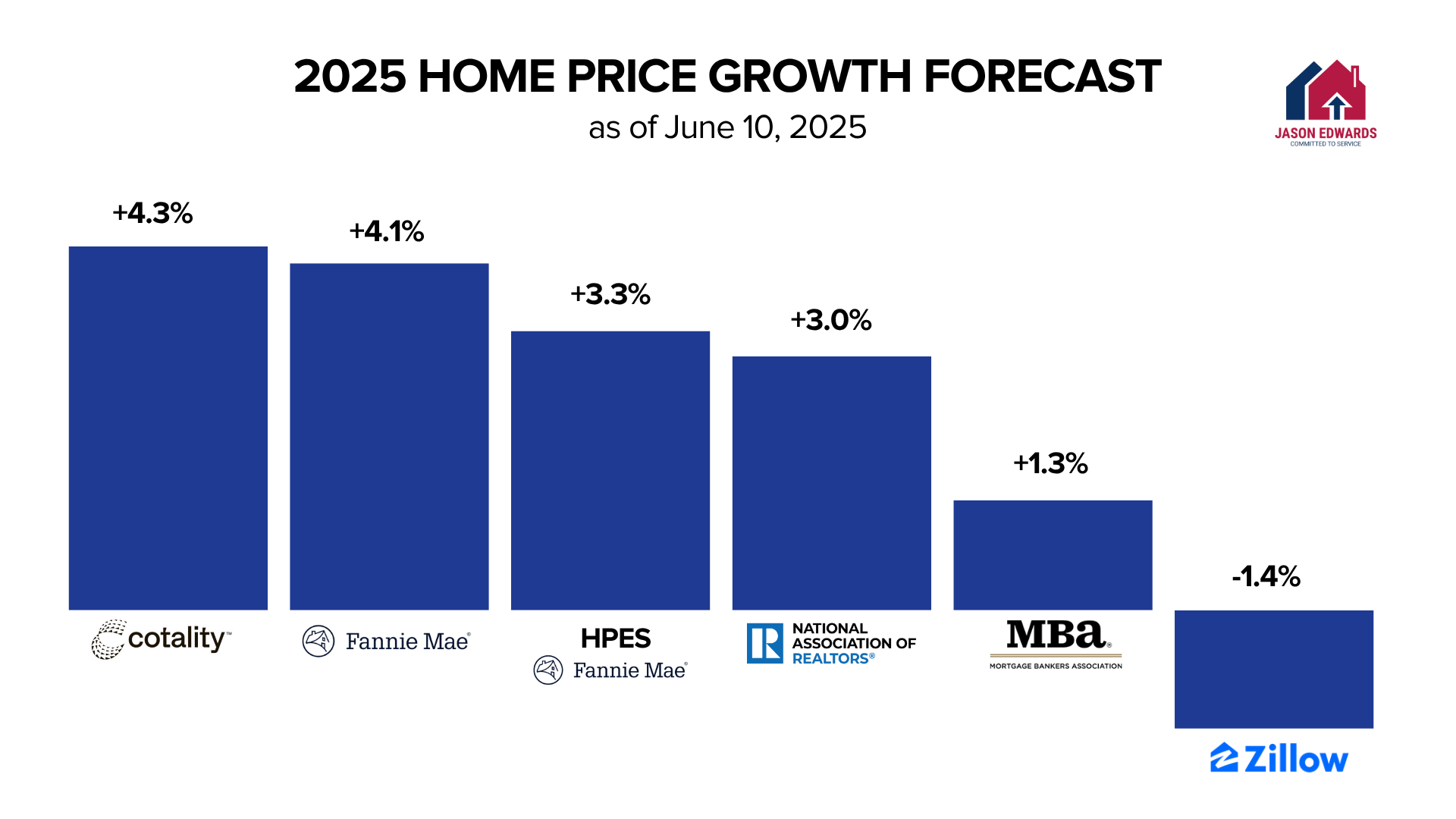

Home Price Forecasts

Most housing economists agree: prices will rise, but not by much. And depending on where you live, they could even decline.

Home price forecasts for 2025:

-

Cotality: +4.3% from April 2025 to April 2026

-

Fannie Mae: +4.1% in 2025

-

Home Price Expectations Survey (HPES): +3.3%

-

NAR: +3% in 2025, +4% in 2026

-

MBA: +1.3% in 2025, <1% in 2026

-

Zillow: -1.4%, an improvement from its earlier prediction of -1.9%

Notably, some overheated markets like Florida, Texas, Hawaii, and Washington D.C. are seeing declines.

Meanwhile, more affordable areas in the Midwest and Northeast are holding strong, especially suburbs near expensive cities.

Across the Hampton Roads region, the housing market is showing signs of a slow but steady rebound. Overall, home prices are up slightly compared to this time last year, though appreciation has leveled off in most cities. The median price across the region has hovered in the low-to-mid $400s, with some suburban pockets seeing stronger gains than the urban cores.

Inventory is improving, with more listings hitting the market this spring and summer—but it’s still not quite a buyer’s market. We’re averaging around 2.5 to 3 months of inventory, and while that’s up from the ultra-tight markets of 2021–2022, it still indicates a slight seller’s edge. That said, days on market are stretching out, and price reductions are becoming more common—especially for listings that aren’t move-in ready or are overpriced.

The $300k–$450k range remains the sweet spot for buyer demand, especially among military and VA buyers. And we’re continuing to see strong interest in properties that are well-priced, well-marketed, and in good condition. Homes that check those boxes are still selling quickly—and in some cases, with multiple offers. But buyers are more cautious and negotiating harder, often requesting closing cost help or rate buydowns.

Bottom line: the Hampton Roads market isn’t crashing—it’s normalizing. And in a market like this, strategy and local expertise make all the difference.

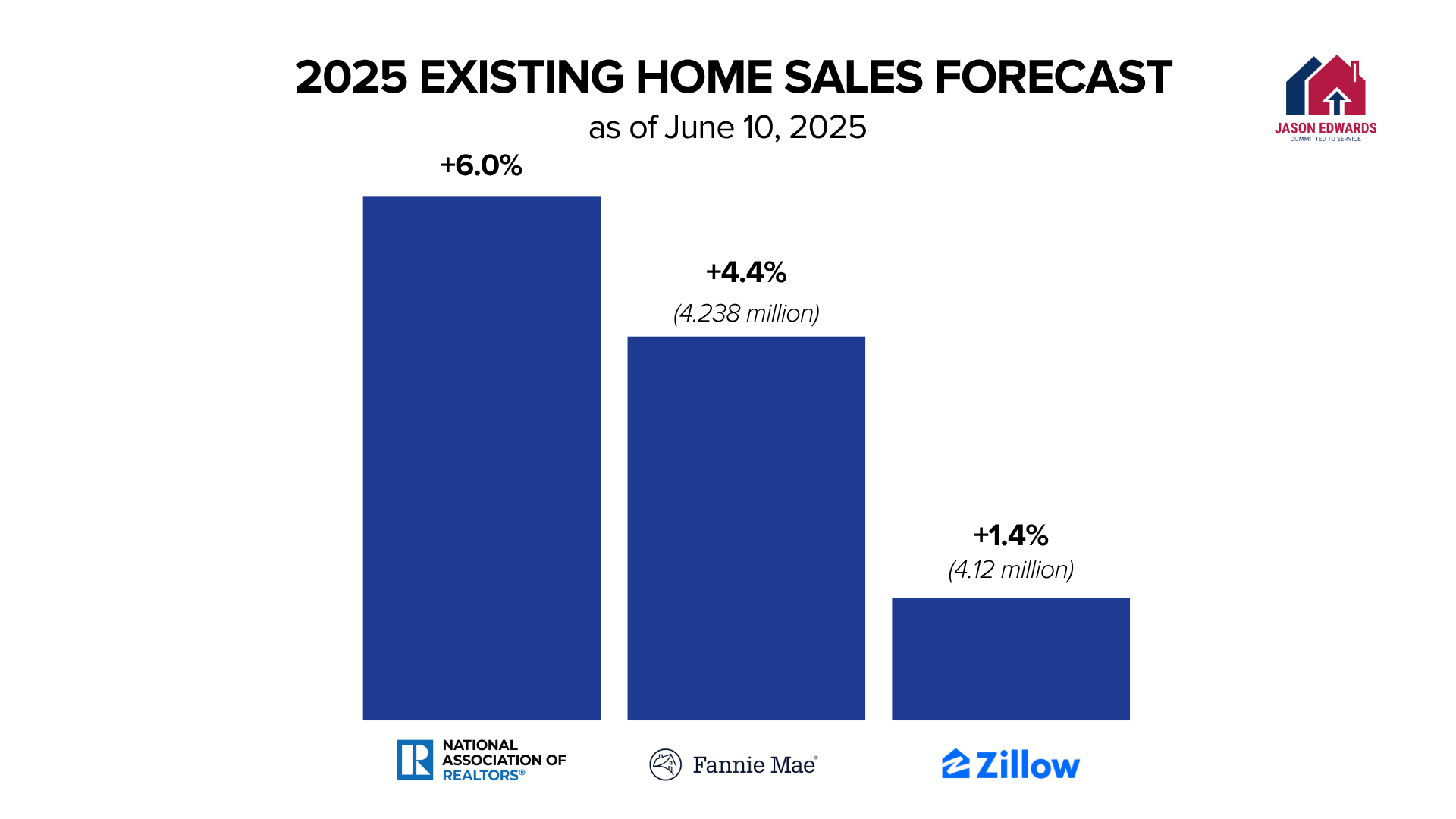

Existing Home Sales Outlook

Sales activity is expected to grow this year, but recovery will be gradual.

Forecasts for existing home sales in 2025:

-

NAR: +6% (with an 11% gain expected in 2026)

-

Fannie Mae: +4.4% (4.24 million home sales)

-

MBA: 4.3 million home sales

-

Zillow: +1.4% (4.12 million home sales)

Improving inventory and gradual rate relief are creating more movement in many markets.

Sales activity across Hampton Roads is picking up—but it’s far from the frenzy we saw a few years ago. We’re seeing more listings hit the market, which is giving buyers a bit more breathing room and increasing overall options across the region. Inventory has improved year-over-year, but we’re still in slightly seller-favored territory, with 2.5 to 3 months of supply depending on the city.

At the same time, days on market are rising, now averaging 50+ days in many areas. That’s a clear sign that overpriced or underprepared homes are sitting longer. Buyers are active—especially VA and first-time buyers—but they’re taking their time, being selective, and expecting value.

We’re also seeing a shift in expectations: buyers are more likely to ask for concessions, repairs, or rate buydowns, and sellers who price strategically are the ones getting attention. The good news? Well-prepped, well-priced homes in the $300k–$450k range are still selling—and sometimes with multiple offers. But the days of listing on Friday and going under contract by Sunday are mostly behind us.

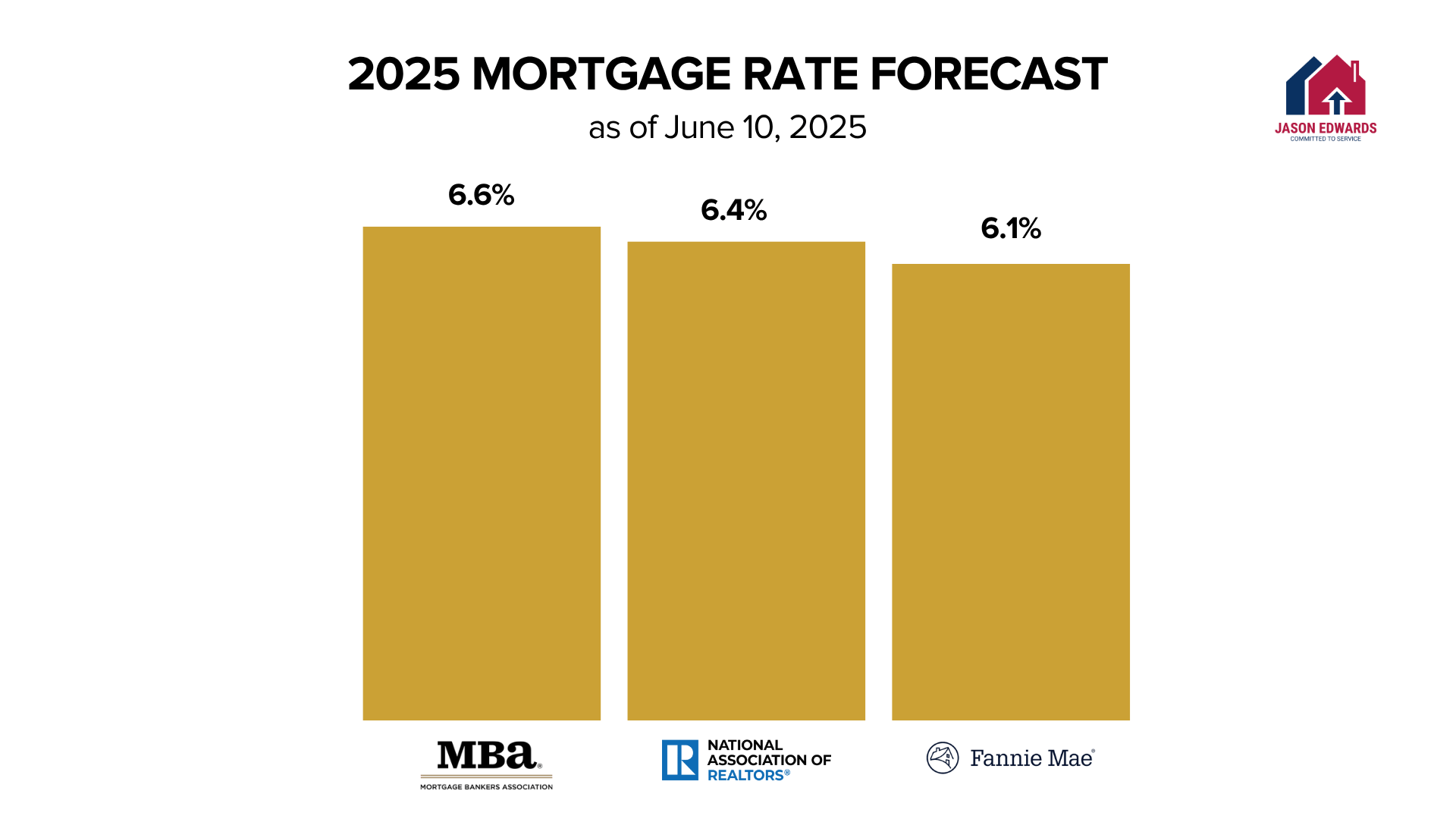

Mortgage Rate Predictions

If you're waiting for mortgage rates to drop below 5%, you’ll likely be waiting a while. But slow, steady improvement is expected.

2025 mortgage rate forecasts:

-

MBA: 6.6% average in Q4 2025; down to 6.3% by end of 2026

-

NAR: 6.4% in late 2025; 6.1% in 2026

-

Fannie Mae: 6.1% by year-end; 5.8% in 2026

Lawrence Yun, NAR’s Chief Economist, calls mortgage rates the “magic bullet” for unlocking market momentum. Lower rates could encourage more buyers, especially first-timers, back into the market.

Buyers in Hampton Roads have mostly come to terms with rates hovering in the mid-6% range—but that doesn’t mean they aren’t factoring those numbers into their decisions. While some buyers are still sitting on the sidelines waiting for a drop, many are moving forward anyway, especially VA buyers who benefit from zero down payment and no PMI.

That said, today’s buyers are budget-conscious and negotiation-savvy. They’re asking for seller concessions, rate buydowns, and even closing cost help to offset monthly payments. In fact, it’s become more common to structure deals with creative financing solutions to make the numbers work.

The dream of 3% interest rates is officially in the rearview mirror, and most serious buyers understand that waiting for perfect conditions could mean missing out entirely. As long as the home and the math make sense, they’re jumping in—strategically.

What This Means for You

Here’s the bottom line for buyers, sellers, and homeowners in today’s market.

Recovery is happening, but slowly. Most forecasts point to modest gains in both home prices and sales volume through the rest of 2025, with more growth expected in 2026.

Mortgage rates are likely to stay above 6%, which means realistic budgeting will remain essential for anyone looking to purchase.

But it’s important to remember that national trends only tell part of the story. Every local market behaves differently, and what’s happening in one region may not apply in another. Even different price points within the same market can experience completely different dynamics!

If you're curious about how these trends are playing out in Hampton Roads, let’s talk. I'm happy to break down what’s happening and how it could impact your plans to buy or sell.

Categories

Recent Posts